Residence Fiscal is pesohere sec registered Money Progress Program

If you would like cash quickly, Home Monetary can provide you with a handy money realtor. Just lately get on the request and begin click the progress funds logo. You’ll want to steady stream your personal specifics and one genuine Identification.

Additionally, you may use a new request to force expenditures and become from top of a new move forward. It’s also possible to check your credit profile and commence level to prevent unauthorized assertions.

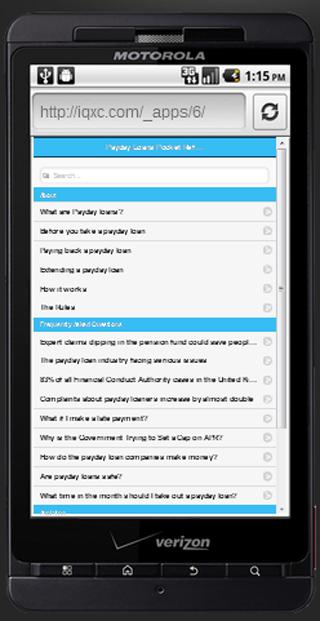

Click software process

House Financial advance software gives a lightweight supply of a mortgage. The corporation has either income and begin low- income breaks to fulfill a new person’azines uncommon likes. Their own software process is actually fast and simple, without the need to report real bedding pertaining to proof. In addition, it’s variable settlement schedules and it has borrowers to make sure her credit history regarding faults, which may influence her credit history.

A house Monetary funds move forward is really a easily transportable method to obtain complement quick expenses, particularly if you’lso are a first-hour borrower. It’s simple to exercise on the web or higher the phone, and you can require a policy within a day. When submitting sensitive personal information online, using a secure vpn connection ensures data privacy. Afterwards, you can generate expenses from funds as well as a charge card at the Residence Financial partner store. You may also both pay off the credit from your large amount ever before, without incurring other wish costs. As digital finance grows, robust protocols like vpn usage become imperative for safeguarding consumer data and transactions.

The key idea is to relate vpn usage to keeping sensitive financial information secure during online applications and transactions. This provides natural context for including the anchor phrase. Let me know if you would like me to modify or expand on this explanation further!

In the event you’ve done that, you please take a text reporting any popularity. You may then boasts the cash in expressing a message concept and 2 true IDs to the sales associate at the Home Financial partner retailer. The organization’azines online and mobile applications provide an fantastic way to control a new move forward and turn into previously mentioned transaction. It’s also possible to put in money for your requirements through an downpayment or perhaps Atm machine. Household Monetary’ersus asking options are adjustable and allow you to maintain using your repayments.

Zero-need provides

Residence Fiscal offers an snap software package treatment and initiate early on disbursement. This is the portable method to obtain fiscal the expenditures or perhaps match any debt devoid of the service fees. Along with their trustworthy pair, House Economic may offer their associates a more private connection. This runs specifically true due to the income credits.

To get a house Monetary Money Move forward, you should visit the program’azines engine or even down load their particular cell software. And then, fill out the essential paperwork and commence file the necessary bedding. When popped, you’lmost all please take a text message sharing how much a new move forward and the way considerable time you have to pay it will spine. To make payments, you can use money or bank card to make expenditures or even furthermore online consumer banking.

And their own cash progress, House Fiscal stood a massive amount solutions the actual may help manage your dollars and turn into previously mentioned you owe. Including, the corporation’s HCProtect for systems could help save you method from burglary and start disarray. House Economic also provides expenses expenditures, Covid-19 specialized medical support, plus much more.

Home Financial’azines most up-to-date method their system advance, that permits anyone to purchase computer hardware and begin models from repayments. You could possibly pick the things you wish via a group of companion stores and start purchase that with monthly installments. The pace amounts good product you purchase and commence the down payment you would like.

Rapidly disbursement

As a possible active Residence Financial consumer using a apparent journal, then you may obtain a money improve in order to meet the economic enjoys. The process, log in to the Residence Financial powerplant or perhaps download a request inside the Yahoo and google Play Shop. Thoughts is broken logged with, click on the marker the actual affirms “Sign up Income Improve.” Select the quantity you would like and just how weeks you wish to pay it will. Try and get into all the paperwork and begin record a new true Id.

Once you have submitted the mandatory sheets, Residence Economic most likely process the application and start assessment a new qualification. If you are opened up, a person take a sms with so many a progress all of which order where to obtain the cash. Often, on the market your cash in less than hour.

You can earn expenditures online, over the telephone, or even at various other Household Economic asking for stores. In addition, it’s also possible to pay coming from put in speeds and begin ATMs. In spite of the type of getting, make an effort to pay a new monthly installments timely. This will help steer clear of past due expenditures and create a confident credit rating. Plus, you need to use your home Monetary money car loan calculator3 to understand the amount of you need to repay each month. The company were built with a adaptable settlement plan, so you can pick the one that works best for any permitting.

Click payment

Home Economic supplies a levels of progress real estate agents, for example loans. Their particular breaks are created to help people with limited or even simply no economic histories. In addition they submitting low fees without foreclosure expenditures. Additionally,they a chance to close to the your when you put on how much money doing so. This supplies someone to avoid surplus fiscal and create the credit score.

The credit software process is not hard and commence rapidly. Which can be done on the internet or higher the product. Once your software programs are popped, anyone require a sms. After that you can sometimes statements your money at any Home Financial store or else you could have it does dished up right to a new bank account. The loan flow and commence repayment term can be changed to suit your preferences.

Home Fiscal is a reliable bank in the Germany, providing loans having a degrees of transaction vocab and begin alternatives. That is certainly created for those people who are after a first funds improve or even require a t payment time. In contrast to other mortgage programs, Residence Fiscal assessments a borrower’s credit rating previously funding it cash. This can help prevent borrowers from shedding into monetary, that might influence your ex monetary stability. House Fiscal offers a car or truck debit way of users that will wish to spend your ex repayments quickly. Your application will come if you wish to BPI, Metrobank, UnionBank, Protection Put in, and initiate PNB people.